I Should Have Been a Cowboy?

Every Spring, Houstonians welcome the Houston Livestock Show and Rodeo back to town. Seeking to educate visitors about agriculture, western heritage, and supporting Texas youth through scholarships, the Houston Rodeo brings the community together for three weeks each year in Texas-sized fashion! Now, I’m not much of a sports fan but I love the Rodeo! It’s always a highlight for me and my family to go and immerse ourselves in the experience. From hatchling chicks and rabbit shows to calf roping teams and bull riders, the rodeo highlights the thrills of living like a cowboy. This year’s trip got me thinking…should I have been a cowboy?

Real cowboys know rodeo is not just a sport and spectacle; it’s a way of life! I decided to lean on my experience and run the numbers. I mean, how hard can it be? Surely, there’s an investment in this cowboy living lifestyle.

Ranch Land vs Stock Market

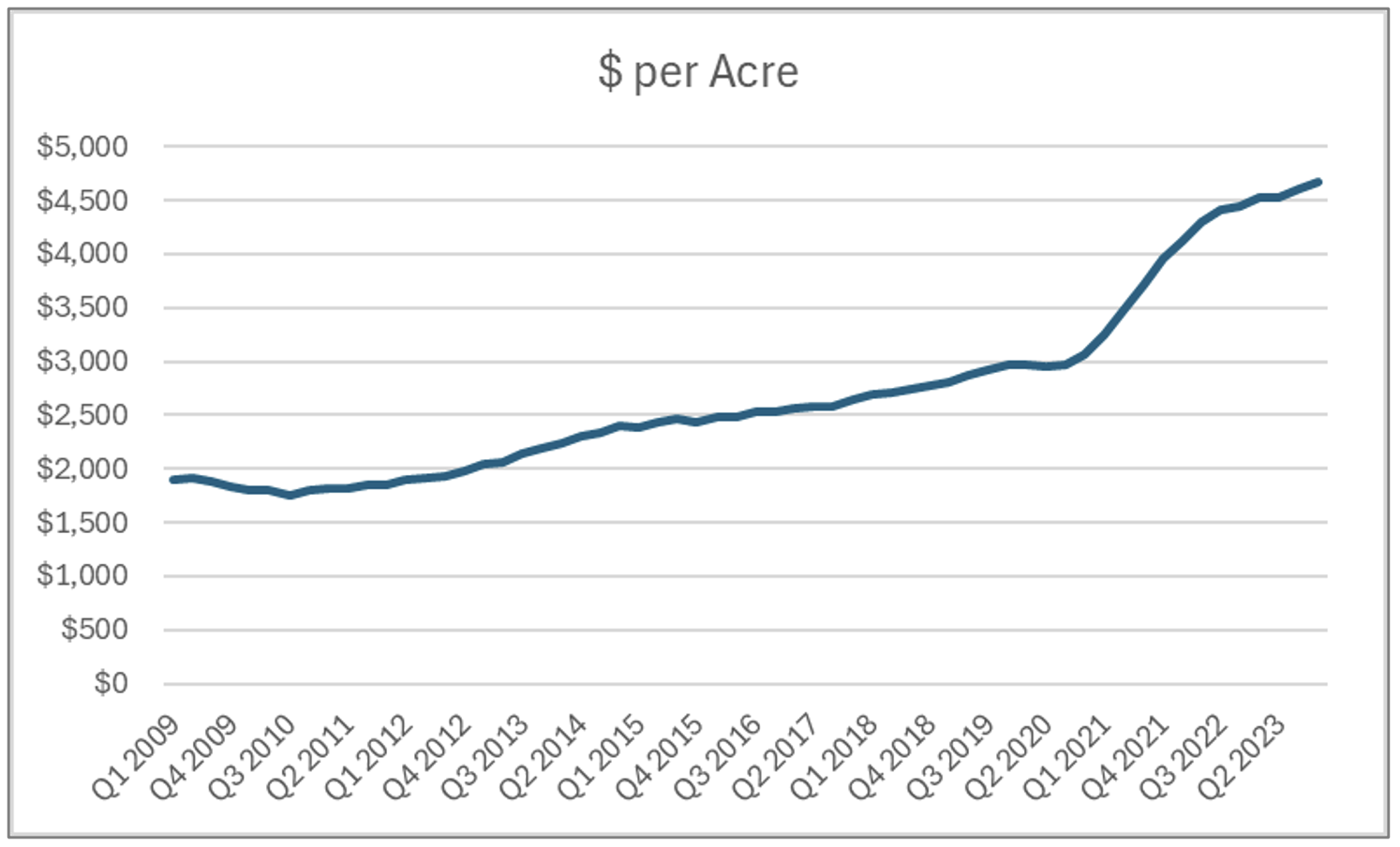

What if someone had invested $1,000,000 in Texas land 15 years ago?

Source: https://www.recenter.tamu.edu/data/rural-land/#!/state/Texas. Data as of 12/31/2023.

Based on average price per acre in 2009, you would have been able to buy 525 acres. Raw land has done very well during this period, increasing at an annualized rate of 6.16%. Land would now be worth $2,451,397.

Stock Market

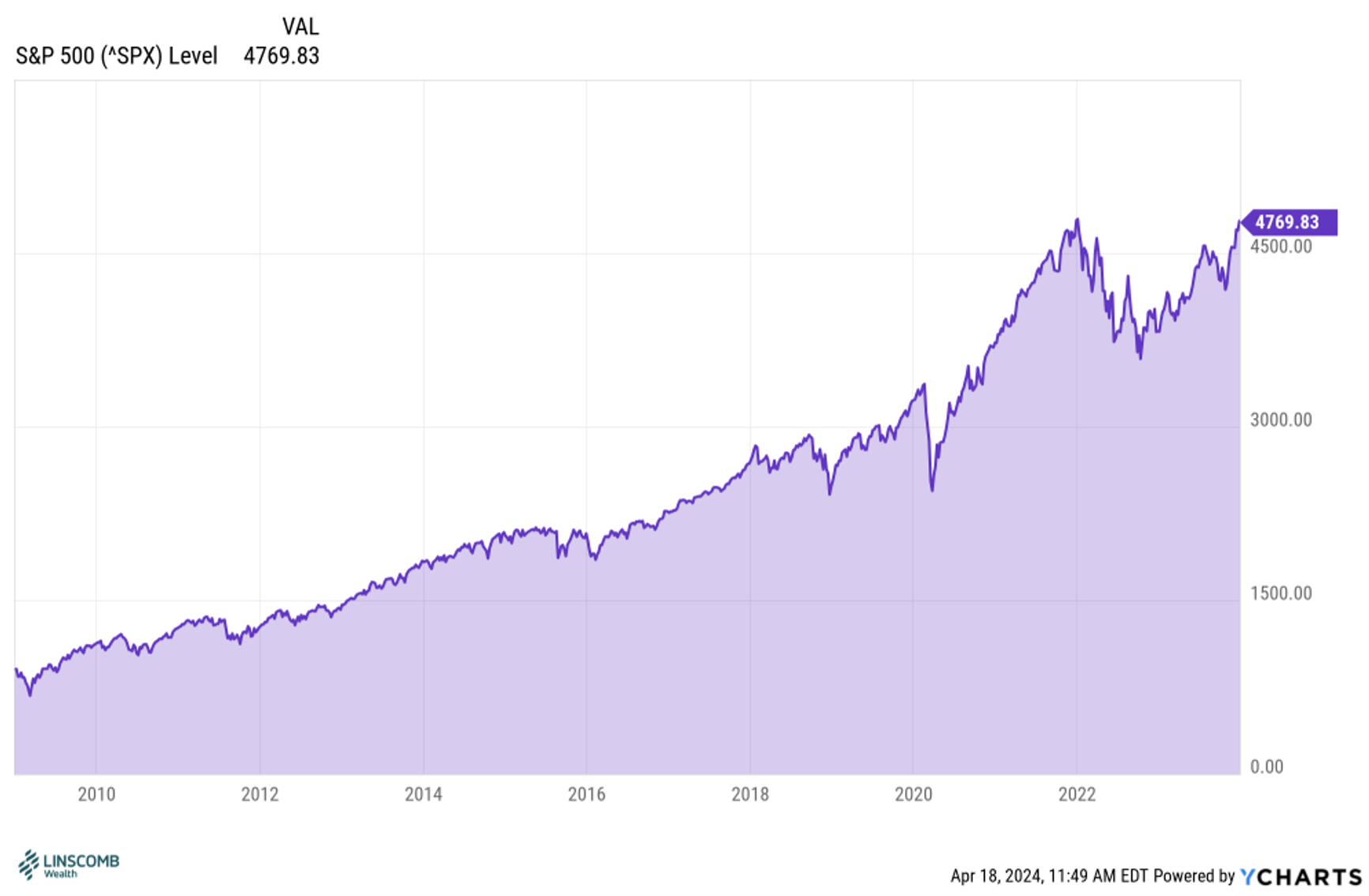

What if that person had invested $1,000,000 in a diversified equity portfolio instead of land?

Source: Ycharts, as of 12/31/2023. The return chart represents the hypothetical growth of $1 million invested in the S&P 500 Level Index. Past Performance is not indicative of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The S&P 500 Level Index is a price return and does not include dividends or the reinvestment of dividends. Returns do not include any investment management, custodial, or other fees that are incurred as a client, which would lower these returns.

A diversified equity portfolio of US large cap equity securities as measured by the S&P 500 level index increased at an annualized rate of return of 11.73% for the period January 1, 2009 – December 31, 2023. The portfolio would be worth $5,166,679.

Could adding livestock make up the difference?

- Profit margins on cattle average between 10-20%

- Average revenue around $1,100 per calf

- $1,100 x .20% = $220

- Difference between diversified equity portfolio and ranch land: $2,715,282

- Number of cows that need to be sold over the period: 12,342.

The Texas Land Association states you can have about 1 cow per acre, pending variables including regions within Texas and breeds of cows*. So, in this example, you can’t have enough cattle to make up the difference. These figures do not include the many other significant capital costs needed to work land and cattle. It takes more than fields of mesquite and cows to get the job done. I didn’t bother running the numbers on feeding the horses (and cowboys!) needed to round up all the cattle when it was time to send the year’s calves to market. I can only imagine the cost of feeding hungry cowboys at the end of a long day in the saddle!

My family and I are always outdoors. We love raising animals and have immense respect for those who make a living out of ranching. Running this evaluation proved I’ll save cowboying as a hobby and keep my day job instead. I’m no Toby Keith either, so I’ll stick with “singin’ those campfire songs” with my kids while pondering if I should have been a cowboy. After all…I’m all hat, no cattle.

*Source for The Texas Land Association: https://landassociation.org/how-many-cows-per-acre-in-texas-get-the-stocking-rate-for-your-area/

Ryan Patterson

Ryan Patterson CFA, CFP® is Linscomb Wealth's Chief Investment Officer.

Read other posts